In the world of finance, there are few things more sought after than a reliable and profitable investment opportunity. Investors are continually on the lookout for ways to grow their wealth while managing risks. Enter Wakala investments, a financial instrument that has been making waves in the world of finance for its ability to generate impressive returns and provide a secure financial future.

Understanding Wakala Investments

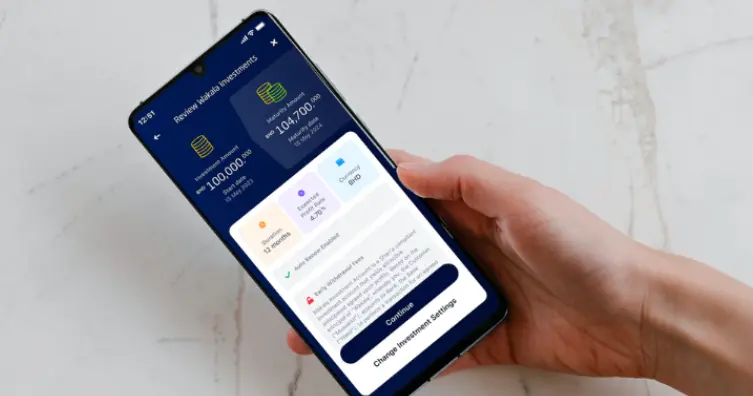

Wakala investments are a type of financial product offered by Islamic financial institutions and banks. These investments adhere to Islamic principles, making them compliant with Sharia law. At the heart of Wakala lies a unique profit-sharing mechanism that allows investors to earn returns while adhering to ethical and religious guidelines.

The Promise of Wakala Investments: Up to 4.5% Per Annum

One of the key attractions of Wakala investments is the potential for impressive returns. These investments can yield up to 4.5% per annum or even higher, depending on the specific terms and conditions of the investment agreement. This rate of return surpasses many conventional investment options and even outpaces the interest rates offered by traditional savings accounts. This rate is currently available at Emirates Islamic Bank.

The Mechanism Behind the Returns

To understand how Wakala investments can offer such competitive returns, it’s essential to grasp the underlying principles of Islamic finance. Unlike traditional interest-based financial systems, Islamic finance prohibits the payment or receipt of interest (Riba). Instead, it encourages profit-sharing arrangements and asset-backed transactions.

In a Wakala investment, the investor acts as an agent (Wakil) who manages the funds on behalf of the principal. The principal, in this case, is the individual or institution seeking to invest their capital. The agent, the Wakil, is responsible for making shrewd investment decisions that generate profits. The profits earned are then shared between the Wakil and the principal, typically with predetermined profit-sharing ratios.

This profit-sharing approach aligns with Islamic finance principles and ensures that the investment remains Sharia-compliant. It also allows for the attractive returns that investors can enjoy.

Diversifying Your Portfolio

Wakala investments offer an excellent opportunity for diversifying your investment portfolio. While they provide competitive returns, they also bring a level of stability and predictability to your financial strategy. This makes them an attractive option for investors looking to balance their risk exposure across various asset classes.

Moreover, the ethical and Sharia-compliant nature of Wakala investments makes them particularly appealing to individuals who prioritize aligning their financial activities with their values and beliefs. With these investments, you can grow your wealth while maintaining the peace of mind that comes from knowing your money is being managed ethically.

Covering Any Rate of Loan: The Versatility of Wakala Investments

One of the unique aspects of Wakala investments is their ability to easily cover the costs of loans. Whether you have outstanding debts or are considering taking out a loan for a specific purpose, the returns can provide you with the financial means to comfortably manage those obligations.

For example, if you have a loan with an interest rate of 3%, and your Wakala investment yields 4.5% per annum, you can effectively cover the cost of the loan and still have a surplus of 1.5% in returns. This surplus can be reinvested or used to further enhance your financial security.

Taking the Leap: Embracing Wakala Investments

In a financial landscape characterized by uncertainty and volatility, Wakala investments stand out as a beacon of stability and profitability. They offer a unique combination of competitive returns, ethical principles, and the versatility to easily cover loans and other financial obligations.

However, it’s important to note that all investments come with some degree of risk, and Wakala investments are no exception. It’s crucial to conduct thorough research, consult with financial experts, and carefully consider your investment goals and risk tolerance before embarking on your Wakala investment journey.

In conclusion, Wakala investments present a compelling opportunity for investors seeking a reliable and ethical means of growing their wealth. With the potential to earn up to 4.5% per annum and the versatility to cover loan costs, they have emerged as a powerful tool for securing a brighter financial future. Consider exploring the world of Wakala investments and discover how they can enhance your financial success.

At the time of writing this article, the rates mentioned here are accurate and subject to potential fluctuations in the future.

You may also like to read:

10 Best Wakala Deposit Accounts in UAE to Grow Your Savings

5 Best Saving Accounts in UAE (2023)