Teach kids that financial education is as important for them as it is for adults. Kids who learn to save money from an early age become responsible adults who can manage their finances well. However, this won’t happen overnight or automatically. As a parent or caregiver, you need to be actively involved in putting the children on the right path.

Teaching your kids about the significance of saving money is a valuable life lesson that can set them on a path to financial success. By instilling good saving habits early in life, kids can likely develop a sense of responsibility, learn to make wise financial decisions and become financially independent individuals in the future.

In this article, we will shed light on some smart and interesting ways to teach kids about saving money.

You might also like to read: 15 Smart Money Habits That Will Change Your Life.

How to teach kids to save money? Simple money saving lessons for kids.

-

-

Talk to them and Have Healthy Discussions

Before your kids step into the world of finances, you must talk to them about money and what it may mean to them. Asking kids about how they want to save, how much they want to save, how much they wish to spend, and what they want to save for can help them become empowered. Healthy financial discussions can teach financial management lessons in a fun and informal way.

-

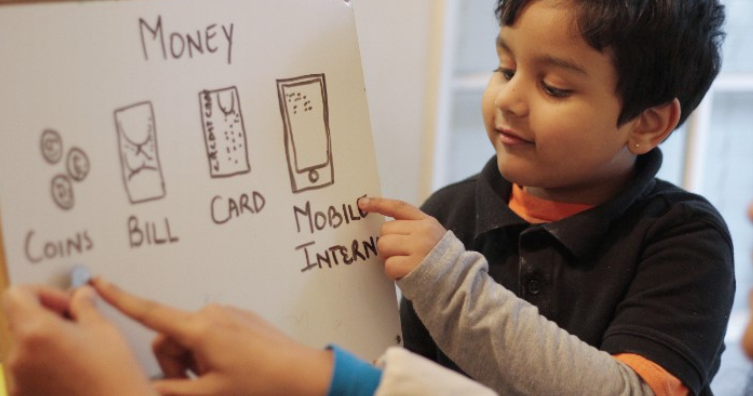

Teach Kids Basic Money Concepts

To lay the foundation for financial literacy for your kids, begin by introducing some basic and simple money concepts. Discuss and explain the value of money and how it is earned through hard work. Tell them how money can be used for different purposes, such as buying groceries, clothes, medicines, fuel, saving, and charity.

-

Set Small Saving Goals

Encourage your children to set some saving goals to provide them with a sense of purpose and motivation. Help kids identify goals or objects they want to save for, such as a board game, a toy, a gadget, or a theme park ticket. Break down the goal into smaller, easily attainable milestones, and track the progress together. This may help children comprehend the pros of delayed gratification and the contentment of accomplishing their goals.

-

Usual Visual/Physical Props

Using visual and physical props can be a powerful way of teaching kids about saving money. You can perhaps use a glass or plastic jar or buy a small piggy bank to let them save their money and belongings. This helps children to actually witness their money growing and serves as a strong visual reminder of their financial goals.

As the savings increase, you can discuss the progress and motivate them by celebrating the achieved milestones. This may encourage them to continue with their saving habits and realize the importance of managing their finances.

-

Try the 3-Jar System

The 3 Jar system is a popular way to teach kids about the importance of budgeting and making conscious financial decisions. With this system, you can provide your kids with three jars and label them as “save,” “spend,” and “give.”

Every time your kid receives money from relatives or family members, you may encourage them to divide their money into three jars depending on their saving goals, spending needs, and charitable contributions. You can guide them along to divide their money wisely. This way of spreading their finances will instill the value of saving money and may promote generosity and empathy toward others.

-

Foster Wise Spending Habits

Besides saving, it’s important to foster wise spending habits in kids. You can discuss the difference between essential needs and wants and help them prioritize their purchases. Kids can also be encouraged to make comparisons between prices and make informed choices accordingly instead of buying things impulsively. By teaching kids to be mindful consumers early on, you can equip them with smart money management skills which can help them in their future life.

-

Involve Kids in Family Budgeting

Involving your little ones in family budgeting and financial decisions can create awareness regarding the management of expenses and money allocation. You can share age-appropriate information and details about essential monthly expenses, budgeting, and saving money for family goals. There are a lot of budgeting games for kids available online that you may consider playing with your children. Moreover, kids can be encouraged to contribute ideas on how the family as a whole can spend money wisely and reduce expenses to save for the future.

-

Open Up a Saving Account for your Kid

You can open a savings account where your children can deposit their money, earn interest, and watch their savings grow. You can find abundant of the best savings account in UAE that you may open for your children and may choose zero interest or zero balance bank account so you wouldn’t have to worry about maintaining a minimum balance. Older kids and teens can manage their accounts online on their mobile devices and keep track of their expenditures and savings smartly. Emirates NBD offers an Early Saver account for your kids.

-

Set an Example

Kids learn best through imitation and observation. You can lead by example and be a role model by demonstrating responsible financial habits. Your children can observe you as you spend, save, and make wise financial decisions. By showcasing your commitment to spending money wisely, you can indirectly reinforce the money-saving lessons as you teach your kids.

-

Offer Incentives and Reward Saving Habits

Offering rewards can be a good way to reinforce your child’s saving habits. To incentivize your children’s saving efforts, you can provide small rewards every time they achieve a saving milestone. Consistent rewards and appraisal practices will reinforce the behavior of saving money and will motivate consistent saving habits. Rewarding small achievements can be valuable in teaching kids about financial responsibility.

-

Final Word

If you are a parent, guardian, or caregiver, teaching your kids how to save money from an early age can set the foundation for a safe and secure financial future. Setting an example and building healthy saving habits from the early years of life helps in making children grow into financially responsible adults.